A policyowner can appeal a decision if an application is denied. Understanding the process and steps to take in such a situation is crucial for policyholders to navigate the complexities of insurance. From gathering necessary documents to submitting a formal appeal, knowing what action can a policyowner take if an application is rejected can make a significant difference in securing coverage. In this article, we will delve into the options available to policyowners facing application denials and provide actionable insights to help them move forward confidently.

What Action Can a Policyowner Take if an Application

As a policyowner, it’s crucial to be familiar with the steps you can take if you encounter issues with your insurance application. Understanding your rights and options can help you navigate any challenges that may arise. Let’s delve into the actions you can consider taking if you face problems during the application process.

Review Your Application Carefully

Before submitting your insurance application, take the time to review it meticulously. Ensure that all the information provided is accurate and up to date. Any errors or omissions could lead to delays or complications down the line. If you spot any mistakes, address them promptly to avoid potential issues.

Contact Your Insurance Agent

If you have any concerns or questions about your application, don’t hesitate to reach out to your insurance agent. They are there to assist you and can provide clarification on any aspects of the application that are unclear. Your agent can also guide you on the necessary steps to rectify any errors or address any issues that may have arisen.

Request a Review of Your Application

If you believe that your application was unfairly denied or if you received an unfavorable decision, you have the right to request a review of your application. Contact your insurance company and inquire about the appeals process. Submit any additional information or documentation that may support your case.

Provide Supporting Documentation

When requesting a review of your application, it’s essential to gather any relevant documentation that can bolster your case. This could include medical records, financial statements, or any other evidence that supports your eligibility for the insurance coverage you applied for. Presenting a strong case can increase your chances of a favorable outcome.

Seek Legal Advice

If you encounter difficulties resolving issues with your insurance application, consider seeking legal advice. A qualified attorney specializing in insurance matters can provide valuable insights and guidance on how to navigate the situation effectively. They can represent your interests and advocate on your behalf during any appeals or negotiations with the insurance company.

Know Your Rights

It’s essential to be aware of your rights as a policyowner when dealing with insurance-related matters. Understanding the terms and conditions of your policy, as well as the applicable laws and regulations, can empower you to make informed decisions and take appropriate action to protect your interests.

File a Complaint

If you believe that you have been treated unfairly during the application process, you have the option to file a complaint with the relevant regulatory authorities. This can prompt an investigation into your case and may lead to a resolution or compensation if any wrongdoing is found. Be sure to provide detailed information and documentation to support your complaint.

Follow Up Regularly

After filing a complaint, it’s important to follow up regularly with the regulatory authorities to check on the progress of your case. Stay informed about any updates or developments and be proactive in providing any additional information or cooperation that may be required during the investigation process.

Consider Alternative Insurance Options

If you are unable to resolve the issues with your current insurance application, explore alternative insurance options that may better suit your needs. Research different insurance providers and policies to find one that aligns with your requirements and preferences. Don’t be discouraged by initial setbacks, as there are always other avenues to explore.

Compare Quotes

When considering alternative insurance options, take the time to compare quotes from different providers. Look at the coverage, premiums, deductibles, and any additional benefits offered by each policy. By conducting thorough research and weighing your options, you can make an informed decision that best meets your insurance needs.

By being proactive and informed, you can take appropriate action if you encounter challenges with your insurance application. Remember to stay patient and persistent throughout the process, and don’t hesitate to seek assistance or guidance when needed. Your insurance coverage is essential for your financial security and peace of mind, so it’s crucial to advocate for your rights and interests as a policyowner.

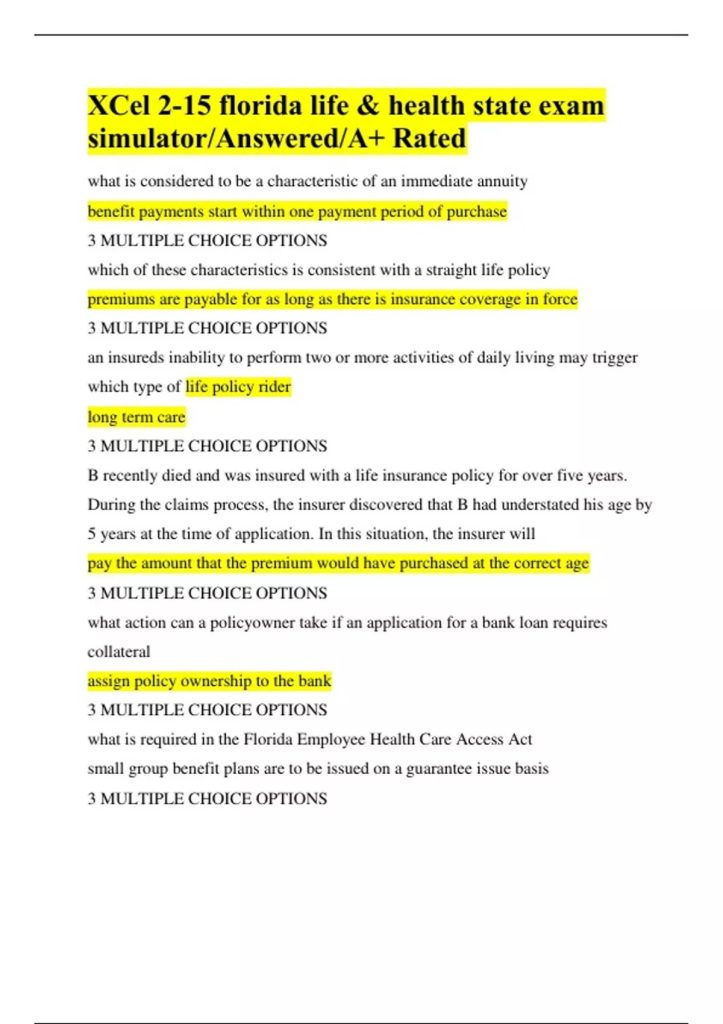

What action can a policyowner take if an application for a bank loan requires collateral

Frequently Asked Questions

What steps can a policyowner take if an application is denied?

If a policyowner’s application is denied, they can first inquire with the insurance company about the reason for the denial. They may have the opportunity to provide additional information or clarification to reconsider their application. If the denial is upheld, the policyowner can explore other insurance providers or review their options with an insurance agent to find a policy that better fits their needs.

How can a policyowner appeal a decision on their insurance application?

If a policyowner disagrees with a decision on their insurance application, they can typically appeal the decision by providing additional documents, medical records, or any other relevant information requested by the insurance company. The policyowner should follow the appeal process outlined by the insurance provider and ensure all necessary steps are taken to present a strong case for reconsideration.

What recourse does a policyowner have if there are discrepancies or errors in their application?

If a policyowner discovers discrepancies or errors in their application after submission, they should promptly contact the insurance company to rectify the inaccuracies. Providing correct and updated information is crucial to ensure the policy is valid and to prevent any potential issues during claims processing. The insurance company may require the policyowner to submit a corrected application or update the information as needed.

Final Thoughts

In conclusion, if an application for insurance is denied, the policyowner can take several actions to address the situation. First, they can request clarification on the reasons for the denial. Then, they may explore appealing the decision or reapplying with additional information to strengthen their case. Engaging with the insurance company and seeking assistance from a professional advisor can also be beneficial in navigating the process. Ultimately, understanding what action a policyowner can take if an application is denied is crucial in determining the best course of action to protect their interests.