Graded benefit whole life insurance provides a unique solution for those who may have difficulty qualifying for traditional life insurance policies. This type of policy offers coverage without the need for a medical exam, making it more accessible to individuals with health concerns. What sets graded benefit whole life insurance apart is its gradual increase in coverage over time, offering financial protection to your loved ones. Let’s delve deeper into the benefits and considerations of this specialized life insurance option.

What is Graded Benefit Whole Life Insurance?

Introduction to Graded Benefit Whole Life Insurance

Have you ever heard about graded benefit whole life insurance? It might sound like a mouthful, but don’t worry – we’re here to break it down for you in simple terms! Graded benefit whole life insurance is a type of life insurance policy that offers coverage for your entire life, with a unique twist. In this blog post, we’ll delve into what graded benefit whole life insurance is all about, how it works, and why it might be a good option for some individuals.

Understanding the Basics of Whole Life Insurance

Before we jump into the specifics of graded benefit whole life insurance, let’s first understand the basics of whole life insurance. Whole life insurance is a type of permanent life insurance that provides coverage for the duration of your life as long as premiums are paid. Unlike term life insurance, which covers you for a specific period, whole life insurance offers lifetime protection.

Features of Whole Life Insurance

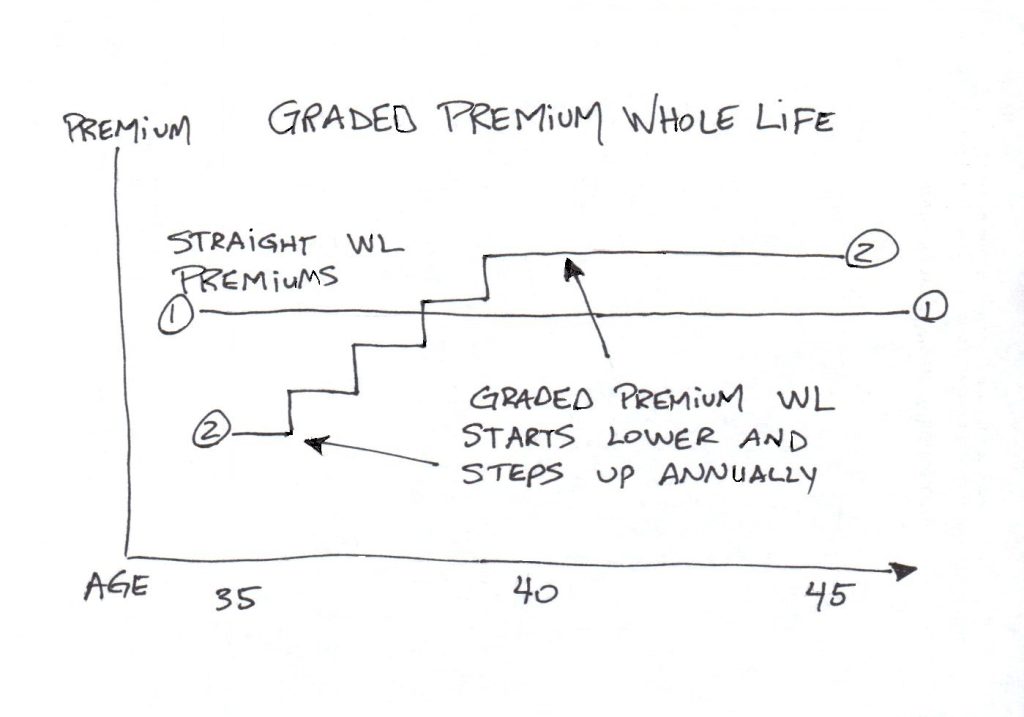

One of the key features of whole life insurance is that it builds cash value over time, which you can borrow against or use to supplement your retirement income. Additionally, whole life insurance premiums remain level throughout the life of the policy, providing a sense of financial security and predictability.

What Makes Graded Benefit Whole Life Insurance Unique?

Now, let’s dive into what sets graded benefit whole life insurance apart from traditional whole life insurance policies. Graded benefit whole life insurance is designed for individuals who may have difficulty qualifying for standard life insurance due to health issues or other reasons. This type of policy provides a guaranteed death benefit, but with a graded payout structure.

Graded Benefit Payout Structure

The graded payout structure means that if the policyholder passes away within the first few years of the policy, the full death benefit may not be paid out immediately. Instead, the beneficiary may receive a percentage of the death benefit based on a predetermined schedule. For example, in the first year of the policy, the beneficiary might receive a percentage of the death benefit, with the full amount becoming payable after a certain number of years.

Benefit of Graded Benefit Whole Life Insurance

While the graded benefit structure may seem like a drawback, it offers an opportunity for individuals who may not qualify for traditional life insurance to still obtain coverage. This type of policy can provide peace of mind knowing that there is some level of protection in place, even if the full death benefit is not payable immediately.

Who Should Consider Graded Benefit Whole Life Insurance?

Graded benefit whole life insurance can be a suitable option for individuals who have pre-existing health conditions or other factors that may make it challenging to secure traditional life insurance. If you’ve been declined for standard life insurance or are concerned about your insurability, graded benefit whole life insurance could be a viable solution.

Factors to Consider

When considering graded benefit whole life insurance, it’s essential to weigh the pros and cons. While the guaranteed death benefit provides some level of security, the graded payout structure means that full coverage may not be immediate. Additionally, premiums for graded benefit whole life insurance policies may be higher than traditional whole life insurance due to the increased risk to the insurance company.

In conclusion, graded benefit whole life insurance offers a unique solution for individuals who may have difficulty obtaining traditional life insurance. While the graded payout structure may require some patience, it provides an opportunity for those with health issues or other challenges to secure coverage. If you’re considering graded benefit whole life insurance, be sure to compare quotes from different insurers and carefully review the policy terms to ensure it aligns with your needs.

Remember, life insurance is an essential tool for financial planning and protecting your loved ones’ future. Whether you opt for traditional whole life insurance or graded benefit whole life insurance, having coverage in place can provide peace of mind and security for you and your family.

What Is Graded Benefit Whole Life Insurance? : Financial Planning & Life Insurance

Frequently Asked Questions

What is graded benefit whole life insurance?

Graded benefit whole life insurance is a type of permanent life insurance policy that is designed for individuals who may not qualify for traditional life insurance due to health conditions or other risk factors. Unlike standard policies, graded benefits mean that the full death benefit is not available immediately upon policy issuance.

How does graded benefit whole life insurance work?

With graded benefit whole life insurance, the policyholder is required to pay premiums like other life insurance policies. However, the death benefit is typically only paid out in full if the insured individual passes away after a waiting period, usually two to three years. If death occurs within the waiting period, the beneficiaries may receive a limited benefit or a return of premiums instead.

Who should consider graded benefit whole life insurance?

Graded benefit whole life insurance is suitable for individuals who have difficulty obtaining traditional life insurance due to health issues or age. It can be an option for those seeking coverage with guaranteed acceptance but are willing to accept a waiting period before the full death benefit becomes available.

Final Thoughts

In conclusion, Graded Benefit Whole Life Insurance is a type of permanent life insurance that offers coverage with limited benefits during the initial years. It is designed for individuals who may have health issues or higher risk factors. This type of policy typically pays out a percentage of the death benefit during the first few years of coverage, with the full benefit becoming available at a later point. Graded Benefit Whole Life Insurance provides a way for individuals to secure life insurance coverage when traditional policies may not be an option.